All-in-One GST Billing Software for Your Business - Fast, Easy and 100% Reliable

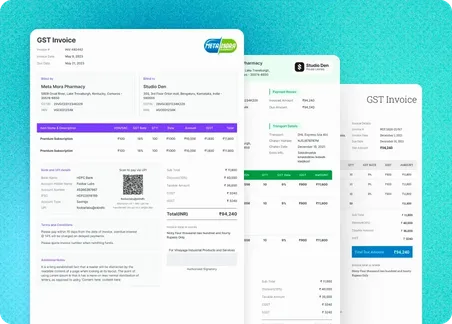

Effortless GST Compliance with Refrens GST Billing Software

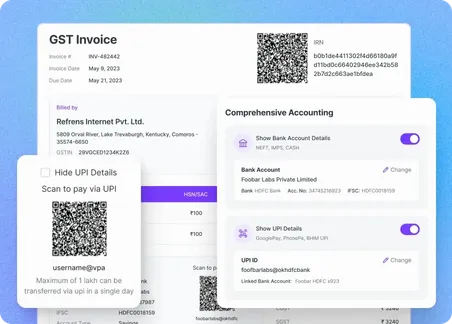

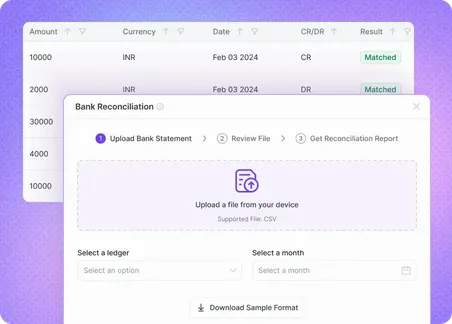

Simplify your financial management with our bank reconciliation feature. Refrens GST invoicing software makes it easy to match your bank statements with your financial records, ensuring accuracy and saving you time. This helps you stay on top of your finances and avoid discrepancies that can lead to errors in your accounting.

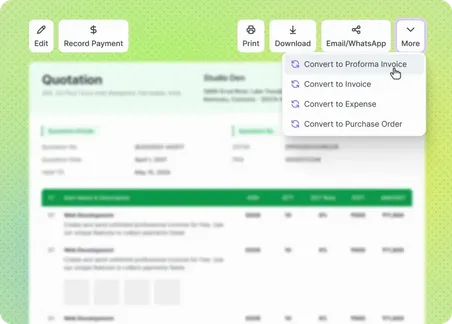

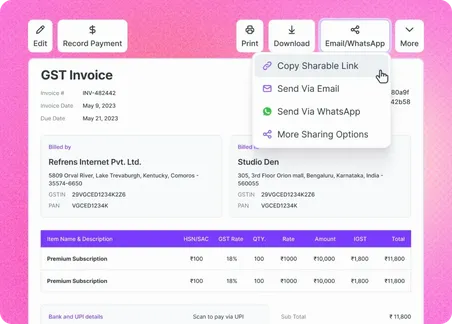

Refrens GST Billing Software Key Features

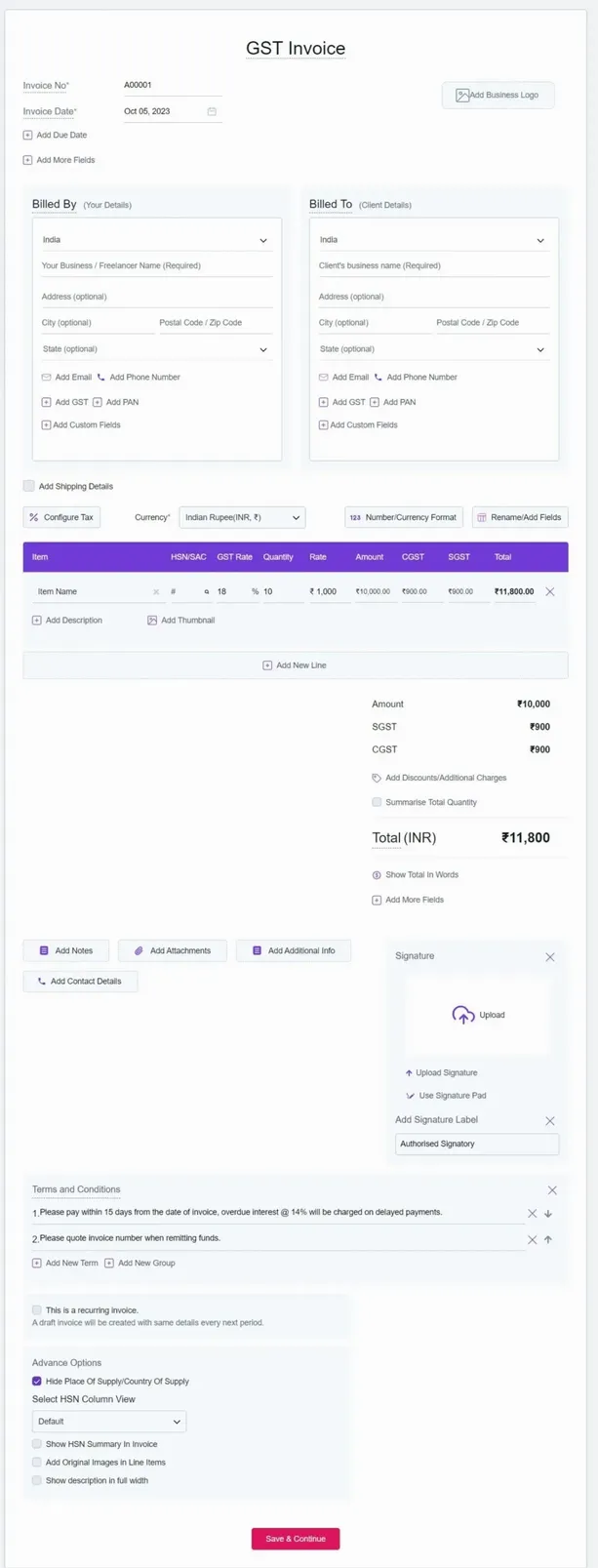

Create Your First FREE GST Invoice

What customers say about Refrens GST Billing Software

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Frequently Asked Questions (FAQ)

Refrens is the best GST billing software for small businesses in India. Here are some of the simple reasons why you should also opt. for Refrens gst billing software.

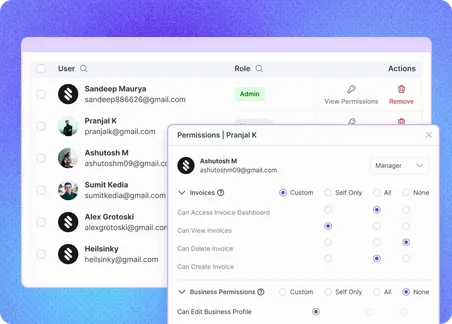

User-Friendly Interface: Refrens has a highly intuitive and easy-to-use interface, making it accessible for businesses of all sizes, including those without extensive technical expertise.

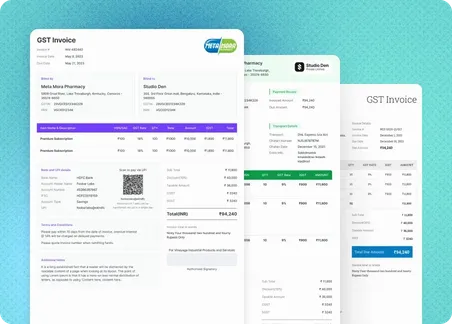

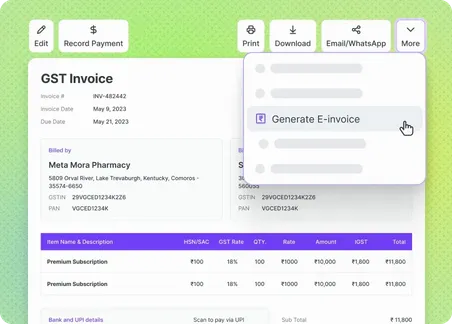

E-Invoicing and IRN Generation: Refrens simplifies the e-invoicing process by automating the generation of Invoice Reference Numbers (IRN), ensuring compliance with government regulations.

GST Compliance: The software seamlessly integrates GST regulations, automatically calculating CGST, SGST, and IGST, helping businesses generate GST-compliant invoices effortlessly.

Affordable Pricing: Refrens offers cost-effective pricing plans that cater to the budgets of small businesses and SMEs, making it a pocket-friendly solution.

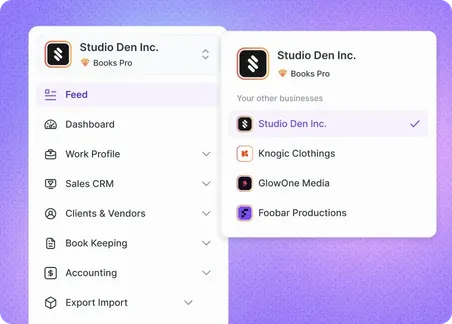

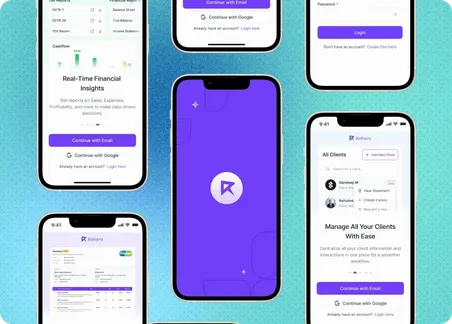

Cloud-Based Accessibility: Refrens operates on the cloud, allowing businesses to access and manage their invoices from anywhere, promoting mobility and flexibility.

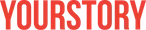

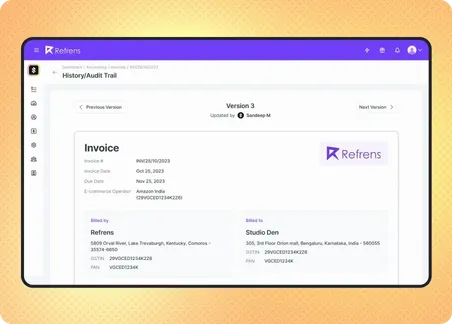

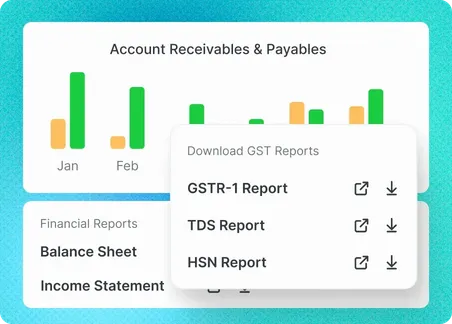

Comprehensive Financial Reporting: The software provides detailed financial reports, empowering businesses to analyze their financial health and make informed decisions.

Simplified GSTR Report Generation: Refrens streamlines the process of preparing accurate GST returns, reducing the complexity of tax compliance.

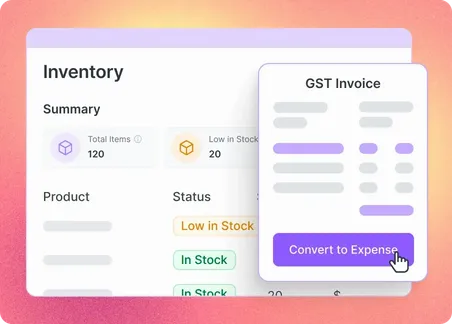

Advanced Inventory Management: The software offers features to track stock levels, monitor item movements, and automate stock-related transactions, enhancing operational efficiency.

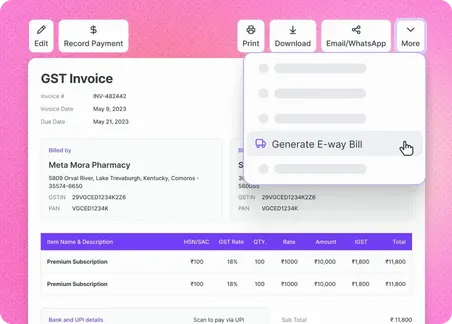

E-way Bill Integration: Refrens integrates with e-way bill systems, simplifying the generation and management of e-way bills, ensuring compliance with transportation regulations.

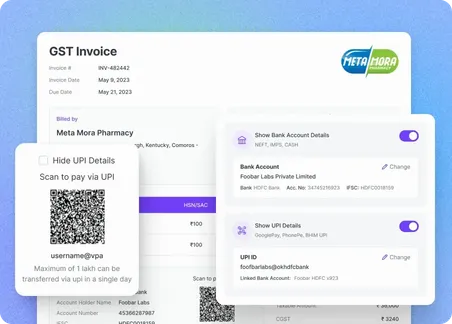

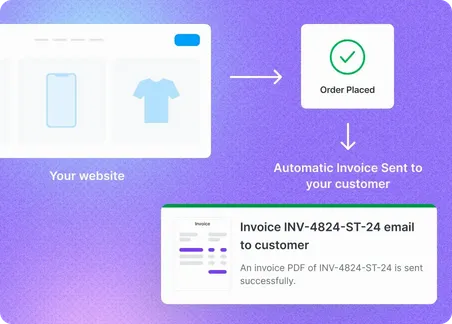

Yes, you can easily accept payments using Refrens. Refrens offers an integrated payment gateway that allows you to accept various digital payment methods directly within the software. This includes options like IMPS, NEFT, RTGS, UPI, debit/credit cards, and net banking. The payment gateway is seamlessly integrated with the invoicing and accounting features of Refrens.

We take utmost care of data security & privacy. Our systems are frequently updated with the latest security updates to ensure that your data is safe and secure. Do check out our detailed privacy policy here.

Yes, we provide instant & reliable support over chat, email, and phone. We will also provide a dedicated account manager to help you out whenever required.

Yes, you can easily generate e-invoices in just a couple of clicks using Refrens’ e-invoicing feature.

Absolutely! Our software is designed to seamlessly adapt and scale alongside your business, ensuring that it meets your evolving needs at every stage of growth. We are also committed to continuously enhancing the software by rigorously adding new features, functionality, and improvements so that your business can always stay ahead of the curve.

As your business expands, our software can accommodate an increasing number of users, manage larger volumes of data, and handle more complex tasks without compromising on performance or efficiency. We regularly update our software to incorporate new technological advancements, industry best practices, and customer feedback, ensuring that you always have access to the latest and most innovative solutions.

Additionally, our cloud-based infrastructure offers unparalleled scalability and reliability, with the ability to adjust resources on-demand to cater to your business's specific needs. This means that you can be confident that our software will support your growth without any disruption or downtime.

- Accounting Software

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software